More enlightened leaders at the Federal Reserve would never have allowed, much less intentionally encouraged, yet the third speculative episode in 15 years. Unfortunately, the idea that repeated cycles of mal-investment and yield-seeking speculation have actually been the cause of the nation’s economic malaise doesn't seem to cross their minds.

John Hussman, June 21, 2015Another Great Depression tried to happen in 2008, nearly 80 years after the start of the last one. Only extraordinary measures of zero interest rates and huge deficit spending here and in China "saved" the world from an economic free-fall. But as of July 2015, some 7 years after the mortgage market meltdown and banking crisis, zero interest rates persist thanks to our Federal Reserve.

Allen Greenspan was widely criticized for leaving short term rates at 1% for several years in the early 2000s and he was correctly blamed for accelerating the housing bubble that ultimately burst in 2007.

But the cure may be worse than the disease. Their policies have managed to create a new housing bubble and new bubbles in stocks and bonds. The Fed has reignited the same bubbles that burst prior to 2008. Just think, our prosperity is dependent on ever rising bubbles!!

Housing prices have soared to new records. "Flip That House" TV show is back too, with dozens more offerings of the same ilk! Unfortunately, the millennial generation finds themselves priced out of the market -- even at near-record low interest rates. This has caused many people to rent instead. But guess what? Rents are soaring as well! Another fine mess your Central Bank has caused.

|

| House Prices At New Highs and Sales Subdued |

Only falling oil prices are helping consumers in the very short term. But longer term, the oil price decline will hurt employment in the oil and gas sector. Layoffs of these high-paying jobs are going to reduce consumer income (in the aggregate). In fact, all commodity prices are falling which, in turn, signals falling demand worldwide. We are witnessing the onset of worldwide deflationary depression. Expect entire countries to experience debt crises and defaults. Even Australia and Canada are finally facing recession and debt trouble.

A college tuition bubble enabled by US government student loan guarantees is burdening millions of young people to the tune of $1.25 Trillion. Delinquencies are now 13% and loans in arrears are about 42% and rising. The point is that high indebtedness of young people is enslaving an entire generation. They aren't in a position to buy a house. The next generation won't be able to afford a house, afford to go to college or afford to live on their own or have their own apartment.

Super low rates are killing savers, retirees, pension funds

Low interest rates are killing retirees and savers. A recent report shows that Federal Reserve zero rates and QE policies have cost savers $470 Billion since 2008. I'm one of them. Retirees and savers that once invested in safe CDs to get 4 or 5% interest rates are now getting nothing. It has forced these same people into the equity markets for higher yields. But that's driven-up prices of stocks to very high levels. Savers have also been forced into bond market whose prices are as high as they have ever been.

Pension funds are also suffering. A recent report from Moody's indicates that some (not all) of the largest pension funds are underfunded by $2 Trillion dollars. It's because treasuries are not yielding enough. Government bond yields of 2 to 3% are not high enough for pension funds who typically target 7% returns to meet their obligations. Insurance companies are suffering in a similar way. So, they are tiptoeing into equities

Interest Rates Can Never Rise Without Widespread Damage

All of this creates problems going forward. What happens when interest rates normalize? Can interest rates ever normalize? If rates go back to "normal" of 4 or 5%, who is left that could afford a home? What about our next generation? Will they be able to afford a house?

When the Federal Reserve tries to increase rates to more "normal" levels, prices of stocks and bonds will drop and hurt savers and investors once again.

And since in public debt in the US is up to $18 Trillion and we're paying $430 billion per year on interest on debt, indicates an average 2.4% interest rate on the national debt. What happens if rates go back to a more normal 5%?? Then interest expense would go up to $860 billion per year!! That would blow up the nation's deficits. Will Federal budgets ever be balanced again?

The Fed has backed themselves into a corner. Can interest rates ever rise? If inflation unexpectedly rises, can the Federal Reserve ever control it? No!

The stock market bubble has given the public a false signal of well-being even though the economy is persistently weak . This false signal, along with $8 Trillion of new debt, has even influenced national elections--to our nation's detriment. The quantitative easing and zero rates have even enabled unlimited spending by Congress. Overall, the damage done by the Federal Reserve is pretty stunning.

.

Stock Market and Other Bubbles Will Burst

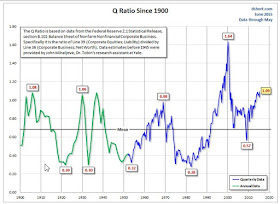

The Federal Reserve has intentionally reignited an equity and bond market boom with their policies. But wait, we are still suffering from the last crash! The stock market now has valuations similar to 2007 and 1929. If history is any guide (it is, of course), the market could drop 70%. That'll pretty much wipe out wealthy people. But hey, it'll fix income inequality that the Left complains about! But everyone will be worse off. It'll kill pension funds and insurance companies, since they have also been forced (along with individual investors) into the stock market.

|

| The Q Ratio is GDP Divided By the Total Stock Market Valuation. A Decline of 70% Can Be Expected If History Is Any Guide |

|

| Deficit (Debt) Spending Doesn't Work Anymore |

No Options Left

So, we now live in a world where we know that "money printing" doesn't work. We know that there is no additional stimulus available from low interest rates, since we're at zero already. And we also know that deficit-financed spending provides very little stimulus. There will be little or no recovery from the next recession since we have no policy tools left. In short, we have no options left. The next recession may become the next "great depression." It might be the greatest depression.

No comments:

Post a Comment

Please send me your message or comments. Thanks in advance.