The legacy of zero interest rates for 7 years has already planted the seeds of our next financial crisis. Super low interest rates, various QEs and China have inflated bubbles in equities, bonds, and housing since the 2008/2009 bust. (After the great recession, it was China and the largest debt-fueled spending binge in history that "saved" the world -- something that can't happen again.). Housing prices are now much higher than the 2007 peak and rents have sky-rocketed. Oh and add the bubbles in subprime auto loans, subprime student loans and the related tuition inflation. But the bubbles are starting to burst as the tide of liquidity has been ebbing all year -- and even before Yellen decided to raise the Fed Funds rate this week.

The lowest quality Junk bonds are falling sharply in value this month. This is not a good thing. In my blog,

Two Charts That Show the Financial Crisis is Already Here, I show the fact that Junk bond issuance in just the past 3 years alone is about 3 times the magnitude of the subprime mortgage bubble in 2007. And recall that the 'blow-up' of subprime mortgages nearly caused the 2nd Great Depression. I don't know the magnitude of subprime credit overseas, but soon, if not already, all the debt of commodity producers and commodity producing country sovereign debts will be subprime with defaults galore in the coming months. The sovereign debt of Brazil was lowered to junk status this week, for example. We're in a slow-motion crash. It might

speed up before it's over. Why?

Maybe it's explained by a trend of falling liquidity? One of the biggest global factors in world finance and leverage in the past 20 years has been the rise and fall of Eurodollars including derivative products such as interest rate swaps. See the graph below taken from Jeffrey Snider at

Alhambra Investment Partners. The Eurodollar's (and Asia dollar) rise drove interest rates lower in the 1990s and 2000s and funded the "world" and financial markets. It was "the wind at our back" for every financial instrument related to rates for a decade or so. But it all came undone in 2008 and 2009, only to be temporarily resuscitated by 2011 via QEs all over the world. But, ever since then, it's been downhill -- meaning lower bank leverage and liquidity. The "wind at our back" has turned into the "wind in our face."

The recent fall of this Eurodollar leverage may be most significant large-scale and long term trend that explains the collapse in China and commodities. And you can see the effect of this reduced leverage when Credit Suisse, Deutsche Bank and Morgan Stanley announce repeated capital raises, layoffs, and/or dividend cuts. Their trading in leveraged products is shrinking as economic activity is slowing. They go hand in hand. World equities are falling and global trade is declining.

Our schoolmarm-ish Chairman of the Federal Reserve, and the vast minions of clueless statististians, and over-educated PhDs, and who have no real world experience, appear blind to this major trend at the heart of the recent and persistent world-wide economic malaise.

So, the Fed Reserve raised the largely symbolic Fed Funds to 0.25 to 0.50 this week. The problem is not the rate rise itself, but even a small 0.25% rise in Fed Funds rate surely will require some removal of liquidity (reduce excess reserves?) at a time when liquidity is already shrinking world-wide. Maybe it had to happen, but I don't think the Fed knows what they are doing. Here's another graph showing shrinking liquidity in 2015 reflecting the same message as the first graphic above.

|

| Global Liquidity Shrinking Before the Fed Raised Rates |

The Federal Reserve, who is supposed to be so sophisticated, is completely missing evidence that their narrative of a strong economy is dead wrong. They appear clueless to the growing evidence of recession in the US and world.

The world and US is tilting toward recession. The fall of Junk credit (and yields rising) is giving a fairly clear signal that a recession is starting in the US. Rates of 16% for a large swath of job producing smaller enterprises snuffs-out any hope of job growth. And already a fairly wide variety of countries in the world are in recession including Canada, Japan, Brazil, Russia and nearly all of the commodity producing countries. Europe may not be in recession but it's close. China appears to be imploding under the weight of bad debt. Recession abroad has caused US exports to decline which hurts US GDP.

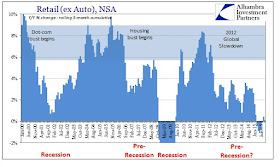

Even most will admit that US manufacturing is in recession. Yeah they say, but it's only 12% of the economy, right? Well, the problem is that manufacturing drives many other sectors, such as transportation and employment. It's no coincidence that the Dow Transportation index is down 20% this year. If manufacturing is in recession, it won't be long before there is a general recession. Already US retail sales in 2015 are the worst since 1990 and they are 70% of the US economy.

|

| US Retail Sales (Ex-Autos) Is Worse Than Recession Levels. Depression Levels? |

|

| US Retail Sales Is Worse Than Recession Levels. Depression Levels? |

Let's sum up the indicators that are nearly shouting recession: US durable goods orders are declining, US retail sales in 2015 are as weak as they have ever been outside of the great recession in 2008/2009, US ISM manufacturing is shrinking, Global trade is declining. US exports are declining. US corporate revenues are declining and corporate profits are now down year over year. These things don't occur together except in contractions. Due to high debt levels across the world, and with interest rates already at near zero levels, this next contraction will last for a long time since there are no policy tools to offset it.

|

| US Manufacturing In Contraction Late in 2015 |

All of the commodity producers are already in recession due to commodity prices dropping to multi-decade lows. This, in turn, causes demand for US exports to decline.

|

| Global Trade is Declining |

Yep, time to raise interest rates, Janet. They don't know what they are doing.

But does anyone is the US government know what they are doing? Nope.

No comments:

Post a Comment

Please send me your message or comments. Thanks in advance.