The US dollar is being intentionally devalued, in part, due to vast and increasing fiscal and trade deficits due to massive government spending that is being substantially funded by "reserve money creation" by the Federal Reserve. Our currency is being radically devalued. Inflation is starting to show up EVEN in the government's lying statistics.

Jesse Felder at The Felder Report says:

in the Repo Crisis of last year, the central bank [was] acting as lender of last resort to the Federal Government. ....in its purest form, [with] a commitment to monetize that amount of debt that could not be absorbed by the market.

....it appears that this commitment has only grown stronger. What it really amounts to is a scenario in which our country’s debt grows so large that the central bank is forced to abandon whatever ostensible [legal] mandate it has been given for a new, unspoken one: print as much money as is required to fund the government and prevent a debt spiral.

As former chief economist for the BIS William White put it, “At some point, people realize that the government can’t support the debt burden without going back to the central bank to print more money. This is a "tipping point.” We have now reached that tipping point.

|

| THIS IS WHAT DESPERATION LOOKS LIKE AT THE US GOVERNMENT AND OUR CENTRAL BANK !! |

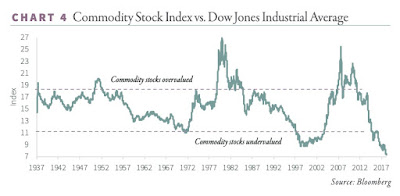

If you look at the chart below from Jesse Felder's post "A Generational Opportunity in Commodities." He says that the dollar could decline another 30 to 40% in the months and years ahead.

If you buy commodity producing stocks, commodity and foreign currency etfs you will stand to benefit handsomely to protect yourself from dollar devaluation. I am not an investment advisor. In fact, I'm frequently very wrong with regard to market commentary (usually too bearish). So please do your own research.

|

| The US Dollar Could Sink 30 to 40% in the Coming Months/Years |

|

| Commodity Stocks Relative to the DJIA. Commodity Stocks Could Soar |

No comments:

Post a Comment

Please send me your message or comments. Thanks in advance.