I've been hearing from a number of quarters that we're in the "Roaring 2020s." I've seen many headlines to that effect. Yes, it feels that way now because government spending (debt) is positively EXPLODING currently. I have learned not to underestimate the power of the Federal Collosus to "kick the can" with even more inflationism and unsound money.

Just this morning, thanks to outrageous incompetence at every level of government, inflation hit 10% annual rate last month. And bond interest rates are 0 to 1.6% per annum?? It's the biggest fuck-up in economic history, right on par with Zimbabwe. Thanks to troglodytes in our Gov't and the Federal Reserve; some of the biggest dumbasses in the world, America IS a 3rd world country and we're broke as hell. Just our unfunded liabilities are some $165 TRILLION---don't kid yourself those liabilities are debt! Add $29 T for the accumulated deficit and we're talking 10X GDP or 60X US Gov't tax revenue (income)!!

Additionally, the Federal Reserve continues it's emergency program of $120 B of

monthly reserve money creation -- which is being used by banks to buy some of

that government debt in order to keep rates from rising. And they probably can't stop any of this without everything falling apart.

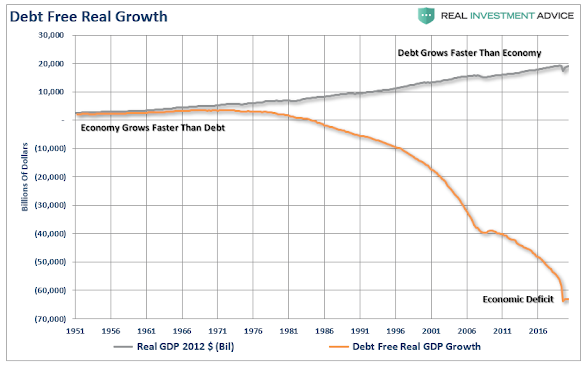

But the surprising thing is that the data shows that the expansion of money (monetary inflation) or government spending does not create real economic growth. This is the fatal flaw of communists and socialists: they eventually fail. In my opinion, it is extremely unlikely that our market, economic and societal future is anything but dreadful for much of the 2020s. I'll explain why.

Market History

The historical comparison to the 1920s vs the present and what it says for the 2020s. First the markets:

|

| Fig 1: The 1920s Stock Boom Started with a PE Ratio of ~5x . Although the current PE is 44.1, it's elevated since we've just emerged from a recession. See the next figure. |

|

||

|

||

|

|

Economic History - Everything Changed in 1971

In my post 1971--The Beginning of the End. Massive Monetary Disorder I said the following:

In 1971, Nixon ended this monetary arrangement (Bretton Woods) which ended gold-backed money. It was done at that time to enable the government to run deficits to fund the Viet Nam war without raising taxes to pay for it. As an immediate result, the US dollar plunged in value and our national debt and inflation began to skyrocket. A falling dollar soon caused the oil exporting countries to sharply raise oil prices in 1974 igniting a budgetary and inflationary spiral.

Then came decades of huge, unsustainable global imbalances in trade and debt, inflation, falling living standards, inequality, monetary disorder, instability, the rise of China, the Petro-dollar, endless wars, the massive military-industrial complex, a leviathan surveillance state, mega corporate monopolies, massive US government growth, government malfeasance and corruption, national de-industrialization, wealth inequality, the Eurodollar rise and fall, widespread US intervention and manipulation in nearly every global nation -- continuing to the present day. All fueled by easy (unsound) money and out-of-control spending.

All of the accumulated damage is discussed additionally in my pivotal post: Extremes in Unsound Money and Finance Will (Eventually) Lead to Catastrophe I discuss in the first 5 or 6 paragraphs of that post how the trends since 1971 will eventually lead to monetary, social and economic disaster/chaos. I suggest that we are already facing that chaos NOW and worsening into our future, ie., the next 2 to 8 years. I fully expect complete economic/social upheaval and world war with major inflation and market crashes of up to 80% declines in the decade ahead.

Now for

the evidence for a very "bad period" lies ahead for the economy and

markets ahead:

| |||||||

|

|

|

| Fig 6: Notice how 1971 (end of sound money) marked the beginning of huge government spending and debt. This is causing annual gains in GDP to decline. |

| ||||

|

|

|

||

The Real GDP Stories

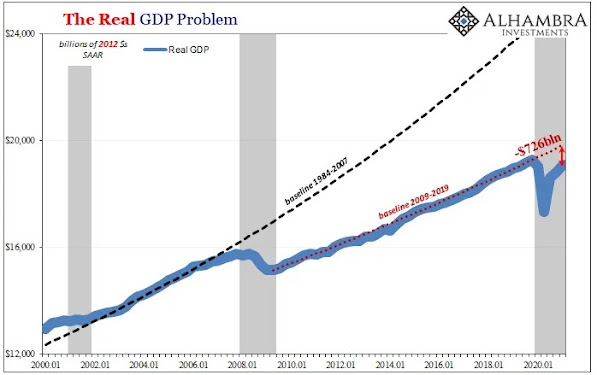

All of the following graphics from the US, China, EU and Mexico show how the entire world economy is slowing and the lost wages and lost GDP continues to add up despite all the "money" (debt) created and thrown around:

|

Fig 10: US GDP Versus Federal Reserve Balance Sheet and Prior Baseline --Stagnation |

|

||

All the Missing Millions of Jobs in the US:

|

||

|

||

|

|

| ||

|

||

Remember this commentary from Doug Nolan at Credit Bubble Bulletin from February 26, 2021. It's applicable in our discussion and observing the current state of our country and markets:

Inequality, speculative Bubbles and manias, resource

misallocation, wealth redistribution and destruction, and deep economic

structural impairment are all consequences of years of unsound money. And it’s

back to this fundamental flaw I’ve been railing against for too long: it is

impossible to resolve Monetary Disorder and the fallout from unsound money

through additional monetary inflation. It’s

destined for catastrophic failure, and it was another week when

inklings of a failing system were observable to those with discerning eyes.

It may be archaic and relegated to the dustbin of history. But one cannot overstate the peril associated with

entrenched unsound money. An insidious corruption of price mechanisms over

time jeopardizes the very foundation of Capitalism. And as Capitalism decays

Democracy flounders. Society frays, while insecurity, animosity, anxiety, and

the forces of distrust are left to fill the void. And as we continue to

witness, the consequences of unsound money incite only more perilous

inflationism.

Other Relevant Gulfcoastcommentary Blogposts:

- The Economy is Nearing Collapse, Part 1: Exploding Government Desperation

- Tverberg: The Economy is Nearing Collapse, Part 2

- Tverberg: "Headed for a Collapsing Debt Bubble"

- Extreme Bubble Phase: The Fed Trapped in Repo, then QE. Either Inflate Bubbles or World Economy Blows Up

- 1971: The Beginning of the End--Massive Monetary Disorder

- How the World Got to the Edge of the Cliff

- European Banks and the Euro Will Destroy the World

- Our Dystopian Future: Recession Without End

- Rising Potential for a Financial System Collapse

- The US Economy on Life Support -- Masking Economic "Depression"

- Rising Risk of Financial and Economic Chaos '

- Rising Risk of Financial & Economic Chaos, Part 2

- Repost from Jan 2018: Why Our Economy Is In Depression And Will Get Only Worse

- Extremes in Unsound Money and Finance Will (Eventually) Lead to Catastrophe

- Economic Stagnation Is Causing Unrest And Leading to Collapse

- America's March to 3rd World Status, Then Collapse

- Declining Global Money Supply Taking World Economy With It

- Big Picture View of the Brewing World Financial Crack-up

- More Debt Won't Work; Charts to Prove It

No comments:

Post a Comment

Please send me your message or comments. Thanks in advance.