This is an ongoing series of posts consisting of "short takes" of notable events that are occurring under our noses that indicate or inform us about how our country and world is falling apart. I say this is an ongoing series because events are happening almost daily now. And it's anyone's guess when dramatic events occur so that everyone will be able to see that we're in a complete crisis.

Note that the highlighted titles in bold and underlined are hyperlinks to the relevant articles or posts.

1) Nature Abhors Exponential Trends: The End of Cheap Energy and Peak Debt Levels Presage Collapse

But cheap oil energy is no longer available for additional barrels demanded.

Oil is available but it's not cheap. If oil prices shoot up to over

$100 or more when extra barrels are demanded like in 2008, or in

response to Chinese demand in 2009/2010, then we've reached the end of

cheap oil. Remember, world GDP growth and energy consumption go hand in

hand. You could say that we've reached "Peak Affordable Oil" rather than "Peak Oil." The truth is that huge amounts of oil will ultimately be left in the ground.

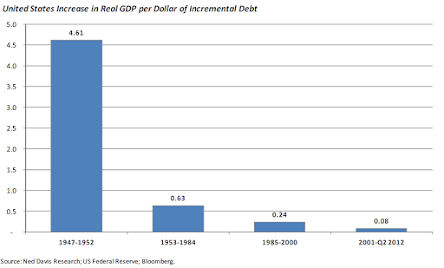

We're also reaching the end of debt's marginal utility, meaning the amount of growth per unit of debt has declined to nearly nothing. It's now nearly the same in China. I call it "debt saturation."

|

| US Increase in Real GDP Per Dollar of Incremental Debt |

2) Nature Abhors Exponential Trends: Our Finite Limits

In the past several hundred years, the Earth's population has exploded exponentially

to 8 billion persons thanks to the use of debt, cheap raw materials,

technology and cheap energy. But the most important is energy as it

provides the means to mine and transport materials and leverages the productivity

of humans and technology. But such asymptotic population trends are

likely not sustainable and subject to collapse.

To support this growth and to feed all of those people, genetically

engineered crops were developed to increase crop yields, oil and gas

production has extended into expensive offshore areas and marginal oil

sand operations, fish and tree farms were built to compensate for

declining fish populations and deforestation, desalination plants have

been built in some areas to supply enough clean water. Add higher rents,

vastly more expensive medical care to the list too. All of these

things, and many more, make life more expensive. Meanwhile incomes are

stagnate or down--certainly for the bottom 90%.

Fundamentally we have an affordability problem affecting most workers

in this country (and world) and it is why consumer spending, and therefore the

economy as a whole, is stagnating.

We've reached the finite limits to growth when the marginal cost of

commodities that support growth, oil is by far the most important one, rise so high that consumers

can't afford it. That happened in 2008 with $145 oil which triggered a

recession and financial crisis. The easy stuff has already been

exploited. Now, even $60 oil might cause the same adverse result since

healthcare, food, rent prices, college tuition and books have rapidly escalated in the past 12 years

thanks to ongoing "emergency" government measures that have continued 12 yrs past

the "crisis." The same thing has happened to nearly every other

commodity after 2009 with China's huge debt-fueled growth program.

Many other factors limit growth: Higher environmental costs of remediation, inadequate clean water, the cost of debt and other costs are hurting every country now. But unaffordable energy costs is the biggest drag for "tapped-out" consumers. China has a huge problem now with unclean water. It will cost more money for China to provide potable water to their citizens.

Ironically, peak (un-affordable) oil means "too low" of oil prices--- not too high. And low oil prices = lower energy supply = falling economic activity = even lower energy prices.

Also we've reached limits of growth when additional debt, on top of our existing debt burden, no longer helps the economy grow. I covered this in my blog post "We're Reaching The End of The Road."

The world, ie., humanity is reaching the limits of growth -- which will eventually

cause adverse debt dynamics (defaults at every level) and a "sudden"collapse.

3) Nature Abhors Exponential Trends: Exponentiality Leads to Finality by Egon von Greyerz at GoldSwitzerland

As technological developments and markets go parabolic, we observe many market “experts”, even intelligent ones, forecasting that we are now in an exponential economic era. Thus many believe that this will go on forever. This is the typical attitude at market and economic tops and guarantees that this does not end well.

It is clearly absolute nonsense to believe that exponential expansion based on deficits, debts and fake money is the beginning of a new era. Anyone studying the economy and history of markets knows that exponential moves indicate the end of an era and not the beginning. As I have repeatedly said, history is our best teacher and it both rhymes and repeats itself. And history now gives us dire warnings.

The longer a trend has gone on for, the more permanent it seems to be. The explosion of population growth does not seem reversible. But the Black Death period in the mid 1300s showed us how population can quickly halve. This was the case in Europe and probably also in the rest of the world.

Just as exponential moves up are spectacular, so are the reversals. And although few people understand it, exponential moves always reverse, at least temporarily. The problem is that the reversal is always faster, more violent and more hair raising than the advance.

A correction of global population from 8 to 4 billion would be totally natural from a statistical point of view. It would obviously be devastating for the world. But if the advance from 1 billion population took 170 years, the “correction” might take at least half of that, say 85 years. Only future historians will tell the world what actually happened.

4) Nature Abhors Exponential Trends: Anatomy of a Bubble and Crash by Charles Hughes Smith

Let's indulge in some basic logic:

- All speculative bubbles pop, regardless of source, time or place. (100% of all historical evidence supports this.) \

- The current "Everything Bubble" is a speculative bubble.

- Therefore the current speculative bubble will pop.

Now that we got that out of the way, the question becomes: how will the crash play out?

There is no way to forecast precisely when or how the current speculative bubble will crash, but

history offers a few potential templates.

The dot-com bubble offers a classic example of bubble symmetry and scale invariance.

(See chart below.) Note how the bubble arose in two legs of X duration and it crashed in two symmetrical

legs of X duration. In both legs, the crash returned to the same levels from which the bubble

took off.

Scale invariance: this same symmetry is visible in bubbles that soar and crash in 6 days, 6 months or 6 years. The symmetry also holds whether the instrument soars from $1 to $5 or $100 to $500, or whether it is in index, commodity or equity.

If bubble symmetry holds this time around, the explosive rallies visible in the charts of the Russell 2000 (IWM) and Global Nasdaq (NOGM) will crash back to their lift-off levels in an equally explosive collapse of similar duration to the explosive rise.

5) Nature Abhors Exponential Trends: Our National Debt 1971: The Beginning of the End--Massive Monetary Disorder

In 1970, US debt was $275 Billion. It took 188 years to achieve that.

Now, the US is selling that amount of debt every week, or even in a day! Debt has truly gone exponential.

|

| US Debt: The Most Dangerous Exponential Trend |

But in 1971, Nixon ended this monetary arrangement which ended gold-backed money. It was done at that time to enable the government to run deficits to fund the Viet Nam war without raising taxes to pay for it. As an immediate result, the US dollar plunged in value and our national debt and inflation began to skyrocket. A falling dollar soon caused the oil exporting countries to sharply raise oil prices in 1974 igniting a budgetary and inflationary spiral.

“ The easy stuff has already been exploited. Now, even $60 oil might cause the same adverse result since healthcare, food, rent prices, college tuition and books have rapidly escalated in the past 12 years thanks to ongoing "emergency" government measures that have continued 12 yrs past the "crisis." The same thing has happened to nearly every other commodity after 2009 with China's huge debt-fueled growth program. ”

ReplyDeleteI could not agree more with your entire article. And what you see in parentheses I’ve been saying now for several years!!!!