Similar and/or related posts from Gulfcoastcommentary:

How the World Got to the Edge of the Cliff

We're Reaching the End of the Road

From Gail Tverberg's Post "Headed for a Collapsing Debt Bubble":

A $1.9 trillion stimulus package was recently signed into law in the United States. Can such a stimulus bill, plus packages passed in other countries, really pull the world economy out of the downturn it has been in 2020? I don’t think so.

The economy runs on energy, far more than it operates on growing debt. Our energy problems don’t appear to be fixable in the near term, such as six months or a year. Instead, the economy seems to be headed for a collapse of its debt bubble. Eventually, we may see a reset of the world financial system leading to fewer interchangeable currencies, far less international trade and falling production of goods and services. Some governments may collapse.

[1] What Is Debt?

I understand debt to be an indirect promise for future goods and services. These future goods and services can only be created if there are adequate supplies of the right kinds of energy and other materials, in the right places, to make these future goods and services.

I think of debt as being a time-shifting device. Indirectly, it is a promise that the economy will be able to provide as many, or more, goods and services in the future compared to what it does at the time the loan is taken out.

Common sense suggests that it is much easier to repay debt with interest in a growing economy than in a shrinking economy. Carmen Reinhart and Ken Rogoff unexpectedly ran across this phenomenon in their 2008 working paper, This Time Is Different: A Panoramic View of Eight Centuries of Financial Crises. They reported (p. 15), “It is notable that the non-defaulters, by and large, are all hugely successful growth stories.” In other words, their analysis of 800 years of governmental debt showed that default was almost inevitable if a country stopped growing or started shrinking.

The IMF estimates that the world economy shrank by 3.5% in 2020. There are many areas with even worse indications: Euro Area, -7.2%; United Kingdom, -10.0%; India, -8.0%; Mexico, -8.5%; and South Africa, -7.5%. If these situations cannot be turned around quickly, we should expect to see collapsing debt bubbles. Even the US, which shrank by 3.4%, needs a rapid return to growth if it is to keep its debt bubble inflated.

[2] The Inter-Relationship Among (a) Growing Debt, (b) Growing Energy Consumption and a (c) Growing Economy

When we are far from energy limits, growing debt seems to pull the

economy along. This is a graphic I put together in 2018, explaining the

situation. A small amount of debt is helpful to the system. But, if

there gets to be too much debt, both oil prices and interest rates rise,

bringing the braking system into action. The bicycle/economy rapidly

slows.

Just as a two-wheeled bicycle needs to be going fast enough to stay

upright, the economy needs to be growing rapidly enough for debt to do

what it is intended to do. It takes energy supply to create the goods

and services that the economy depends on. If oil and other energy products are cheap to produce, their benefit

will be widely available. Employers will be able to add more efficient

machines, such as bigger tractors. These more efficient machines will

act to leverage the human labor of the workers. The economy can grow

rapidly, without the use of much debt. Figure 2 shows that the world oil

price was $20 per barrel in 2020$, or even less, prior to 1974.

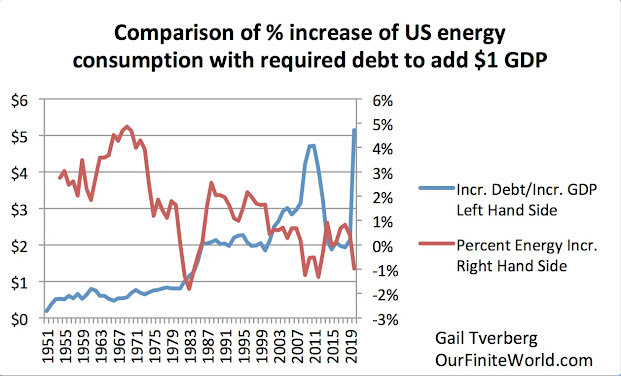

Based on Figure 3, the US average annual growth in energy consumption (red line) generally fell between 1951 and 2020. The quantity of debt that needed to be added to create an additional $1 dollar of GDP (blue line) has generally been rising.

According to Investopedia, Gross domestic product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period. Notice that there is no mention of debt in this definition. If businesses or governments can find a way to make large amounts of credit available to borrowers who are not very credit worthy, it becomes easy to sell cars, motorcycles or homes to buyers who may never repay that debt. If the economy hits turbulence, these marginal buyers are likely to default, causing a collapse in a debt bubble.

[3] Analyzing Energy Consumption Growth, Debt Growth and Economic Growth for Broader Groupings of Years

To get a better idea what is happening with respect to energy growth, debt growth, and GDP growth, I created some broader groupings of years, based primarily on patterns in Figure 2, showing inflation-adjusted oil prices. The following groupings of years were chosen:

- 1950-1973

- 1974-1980

- 1981-2000

- 2001-2014

- 2015-2020

Using these groupings of years, I put together charts in which it is easier to see trends.

Figure 4 shows that for the US, there has been a general downward trend in the annual growth of energy consumption. At same time, real (that is, inflation-adjusted) GDP has been trending downward, but not quite as quickly.

We would expect that lower energy consumption would lead to lower growth in real GDP because it takes energy of the appropriate kinds to make goods and services. For example, it takes oil to ship most goods. It takes electricity to operate computers and keep the lights on. According to the World Coal Association, large quantities of coal are used in producing cement and steel. These are important for construction, such as is planned in stimulus projects around the world.

Also, on Figure 4, the period 1981 to 2000 shows an uptick in both

energy consumption growth and real GDP growth. This period corresponds

to a period of relatively low oil prices (Figure 2). With lower oil

prices, businesses found it affordable to add new devices to leverage

human labor, making workers more productive. The growing productivity of

workers is at least part of what led to the increased growth in real

GDP.

Figure 5, above, is disturbing. It strongly suggests that the US economy (and probably a lot of other economies) has needed to add an increasing amount of debt to add $1 of GDP in recent years. This pattern started long before President Biden’s $1.9 trillion stimulus package in 2021.

To make matters worse, GDP growth in Figure 5 has not been reduced to remove the impact of inflation. On average, removing the impact of inflation reduces the above GDP growth by about half. In the period 2015 to 2020, it took about $4.35 of additional debt to add one dollar of GDP growth, including inflation. It would take about double that amount, or $8.70 worth of debt, to create $1.00 worth of inflation-adjusted growth. With such a low return on added debt, it seems unlikely that the $1.9 trillion stimulus package will increase the growth of the economy very much.

[4] Falling interest rates (Figure 6) are a major part of what allowed the rapid growth in debt after 1981 shown in Figure 5.

Clearly, debt is more affordable if the interest rate is lower. For example, auto loans and home mortgages have lower monthly payments if the interest rate is lower. It is also clear that governments need to spend less of their tax revenue on interest rate payments if interest rates are lower. Changes made by US President Ronald Reagan when he took office 1981 also encouraged the use of more debt.

A major concern with respect to today’s debt bubble is the fact that interest rates are about as low as they can go without going negative. In fact, the interest rate on 10-year Treasury bonds is now 1.72%, which is higher than the February 2021 average rate shown on the chart. As interest rates rise, it becomes more costly to add more debt. As interest rates rise, businesses will be less likely to take on debt in order to expand and hire more workers.

[5] Interest expense is a major expense of governments, businesses, and homeowners everywhere. Energy costs are another major expense of governments, businesses, and homeowners. It makes sense that falling interest rates can partly hide rising energy prices.

A trend toward lower interest rates was needed starting in 1981 because the US could no longer produce large amounts of crude oil that were profitable to sell at less than $20 per barrel, in inflation-adjusted prices. Lower interest rates made adding debt more feasible. This added debt could smooth the transition to an economy that was less dependent on oil, now that it was high-priced. The lower interest rates helped all segments of the economy adjust to the new higher cost of oil and other fuels.

[6] The US experience shows precisely how helpful having a rapidly growing supply of inexpensive to produce oil could be to an economy.

US oil production, excluding Alaska (blue “remainder” in Figure 7),

rose rapidly after 1945 but began to decline not long after hitting a

peak in 1970. This growing oil production had temporarily provided a

huge boost to the US economy.

Up until almost 1970, US oil production was rising rapidly. Figure 8 shows that during this period, incomes of both the bottom 90% of workers and the top 10% of workers increased rapidly. Over a period of about 20 years, incomes for both groups grew by about 80%, after adjusting for inflation. On average, workers were about 4% better off each year, with the rapid growth in very inexpensive-to-produce oil, all of which stayed in the US (rather than being exported). US imports of inexpensive-to-produce oil also grew during this period.

Once oil prices were higher, income growth for both the lower 90% and

the top 10% slowed. With the changes made starting in 1981, wage

disparities quickly started to grow. There suddenly became a need for

new, high-tech approaches that used less oil. But these changes were

more helpful to the managers and highly educated workers than the bottom

90% of workers.

|

| Figure 8. Chart comparing income gains by the top 10% to income gains by the bottom 90% by economist Emmanuel Saez. Based on an analysis of IRS data, published in Forbes. |

[7] Most of the world’s cheap-to-extract oil sources have now been exhausted. Our problem is that the world market cannot get prices to rise high enough for producers to cover all of their expenses, including taxes.

Based on my analysis, the world price of oil would need to be at least $120 per barrel to cover all of the costs it needs to cover. The costs that need to be covered include more items than an oil company would normally include in its costs estimates. The company needs to develop new fields to compensate for the ones that are being exhausted. It needs to pay interest on its debt. It also needs to pay dividends to its shareholders. In the case of shale producers, the price needs to be high enough that production outside of “sweet spots” can be carried on profitably.

For oil exporters, it is especially important that the sales price be high enough so that the government of the oil exporting country can collect adequate tax revenue. Otherwise, the exporting country will not be able to maintain food subsidy programs that the population depends on and public works programs that provide jobs.

[8] The world can add more debt, but it is difficult to see how the debt bubble that is created will really pull the world economy forward rapidly enough to keep the debt bubble from collapsing in the next year or two.

Many models are based on the assumption that the economy can easily go back to the growth rate it had, prior to COVID-19. There are several reasons why this seems unlikely:

- Many parts of the world economy weren’t really growing very rapidly prior to the pandemic. For example, shopping malls were doing poorly. Many airlines were in financial difficulty. Private passenger auto sales in China reached a peak in 2017 and have declined every year since.

- At the low oil prices prior to the pandemic, many oil producers (including the US) would need to reduce their production. The 2019 peak in shale production (shown in Figure 7) may prove to be the peak in US oil production because of low prices.

- Once people became accustomed to working from home, many of them really do not want to go back to a long commute.

- It is not clear that the pandemic is really going away, now that we have kept it around this long. New mutations keep appearing. Vaccines aren’t 100% effective.

- As I showed in Figure 5, adding more debt seems to be a very inefficient way of digging the economy out of a hole. What is really needed is a growing supply of oil that can be produced and sold profitably for less than $20 per barrel. Other types of energy need to be similarly inexpensive.

I should note that intermittent wind and solar energy is not an adequate substitute for oil. It is not even an adequate substitute for “dispatchable” electricity production. It is simply an energy product that has been sufficiently subsidized that it can often make money for its producers. It also sounds good, if it is referred to as “clean energy.” Unfortunately, its true value is lower than its cost of production.

[9] What’s Ahead?

I expect that oil prices will rise a bit, but not enough to raise prices to the level producers require. Interest rates will continue to rise as governments around the world attempt more stimulus. With these higher interest rates and higher oil prices, businesses will do less and less well. This will slow the economy enough that debt defaults become a major problem. Within a few months to a year, the worldwide debt bubble will start to collapse, bringing oil prices down by more than 50%. Stock market prices and prices of buildings of all kinds will fall in inflation-adjusted dollars. Many bonds will prove to be worthless. There will be problems with empty shelves in stores and gasoline stations with no products to sell.

People will start to see that while debt is a promise for the equivalent of future goods and services, it is not necessarily the case that those who make the promises will be able to stand behind these promises. Paper wealth generally can be expected to lose its value.

I can imagine a situation, not too many years from now, when countries everywhere will establish new currencies that are not as easily interchangeable with other currencies as today’s currencies are. International trade will dramatically fall. The standard of living of most people will fall precipitously.

I doubt that the new currencies will be electronic currencies. Keeping the electricity on is a difficult task in economies that increasingly need to rely solely on local resources. Electricity may be out for months at a time after an equipment failure or a storm. Having a currency that depends on electricity alone would be a poor idea.