Gulfcoastcommentary at Substack: https://gulfcoastcommentary.substack.com/

Gulf Coast Commentary

Commentary on current events, culture, economics, markets and politics

Saturday, March 29, 2025

Friday, March 7, 2025

WaPo Employees Self-Emolating When Bezos Requires Writing about Free Markets and Personal Liberties: Heads exploding like vampires in the sun..

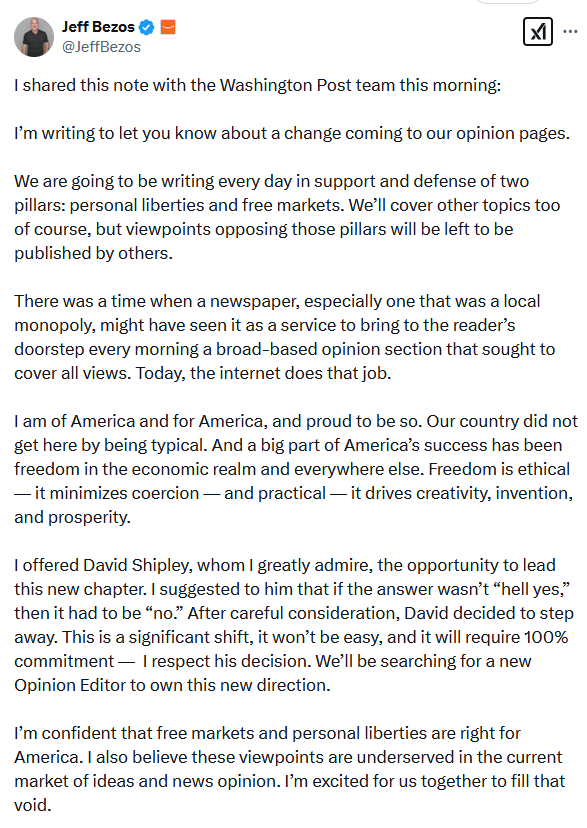

Jeff Bezos, owner of the Washington Post, declared that the paper will be now dedicated to the following:

We are going to be writing every day in support and defense of two pillars: personal liberties and free markets. We’ll cover other topics too of course, but viewpoints opposing those pillars will be left to be published by others.

It’s amazing that there are mass resignations at the WaPo! Editors, writers, etc are quitting in mass. It’s as if they are vampires being exposed to sunlight for the first time:

All those spoiled little brats at the WaPo, who never have done an honest day’s work in their lives, are suddenly required to be pro-USA and pro-Freedom. Here’s his entire missive:Maybe there’s a new growth industry to be had where people like the Amish, cattle ranchers, roughnecks on drilling rigs, coal miners, drill sargents offer, for pay, a (forced) “sabbatical,” or “reality training program” where parents or employers can send them (by force) to learn about real work situations where you actually must do REAL work and/or physical training for a month or two or three.

These programs would be for spoiled, fat-ass brats who are having trouble adapting to reality (and don’t even know it); those who waste their days hanging out at Mom’s basement where they harass conservatives online in splendid anonymity and those who do no work or work at a no-skill “jobs”—like at Starbucks.' Yes, their heads would explode.

That’s right, up at dawn to feed the cattle, or gather the cows to be milked, or shovel horseshit out of the barn, drive a tractor to plow the field, report to work at widget factory where the shift starts at 6am. Or how about military training: up at 6 am for a 5 mile run, 100 pushups, 15 pull-ups before the sun rises?

I’ve said it before many times that FAR TOO MANY AMERICANS are living in a crazy dream world thoroughly detached from reality and an honest day’s work. That’s the WaPo team explained to a tee (and so many others)! Maybe Bezos has been getting the subsidies from USAID and now he’s not??

From Why the Left is Disconnected from Reality and Destroys Everything from Vince Coyner at American Thinker:

“The Left today are found almost exclusively in the following: government employees, students, college-educated white women working inside large corporations, Wall Street, Academia, the cabal of NGOs, the “Media,” and the 40 million who suckle on the government benefits. Few of these people do anything remotely productive for the economy.

Virtually the entire Left in this country has zero connection with anything having to do with creating anything, growing anything, building anything, or risking anything. They spend their days pushing paper in offices or selling cappuccinos, if they work at all. Not only are few of them farmers, but few are truckers, lumberjacks, steel workers, plumbers, electricians, or entrepreneurs. Few have ever had to balance paying a credit card bill versus making payroll. Few ever risked their money and invested sweat equity to start a business.”

These people don’t even Know Where Their Food Comes where I said:

In my recent and long post Economic, Cultural and Spiritual Declines Are Causing Mass Anxiety and Mental Breakdowns, I wrote that we've allowed ourselves to become divorced from our history, our culture, our heritage, our religions. It goes even further than that.

People that live and work in our big cities, the large megalopolises, the big universities and around"Government"[Leftwing “newspapers”??] are often completely disconnected from everything that is important. They don’t even know from where their food comes.

I remember Mayor Bloomberg, when he tried to get into politics, making fun of farmers when he said, "Gee, you poke a hole in the ground, and drop in a seed!" What could be easier?" But he was so tone deaf that even New Yorkers didn't vote for him.

First, he has no idea of how difficult and risky farming is. He has no idea how hard farmers have to work to make a living. It's said that farming is the only profession where you have to buy "inputs" at retail prices and sell your product at wholesale prices.

Bloomberg and millions of others in the New York city area, and on both coasts, are basically parasites, feasting on the fabulously wealthy financial system.

Most people who live around and work in “government,”universities, big Media, big Tech, show business, government think tanks, NGOs, the Federal Reserve usually are amazingly ignorant, full of their academic and/or Marxist theories, full of leftist propaganda and frankly full of shit. There, they can be and often are completely wrong about everything for all of their lives and never have to face any consequences.

I think consequences are just starting for a lot of people. One can hope.

Wayne Root: All Roads Lead to Obama; the Fraudulent "Manchurian" Candidate and Professional Communist- All 3 Terms

All roads lead to Obama. He is the shot caller. He is the communist traitor behind everything bad that has happened to America, the US economy, and President Trump.

I believe it all started at Columbia University.

Yes, I have a history with Obama. We were college classmates at Columbia University. We were both Pre-Law and political science majors. We both graduated on the same day in 1983. We both went into politics eventually.

That’s where the similarities ended.

I’m a conservative warrior and capitalist evangelist. I made millions of dollars as a risk-taking entrepreneur in the business world. He became a “community organizer” (ie a communist traitor).

I’m pro-business. I believe in economic and personal freedom, free speech, limited government, low taxes and very little regulation.

Obama hates business. He believes in socialism, massive taxes and government regulation, the green energy scam, open borders and the weaponization of government against free speech.

Trust me, the root (excuse the pun) of everything bad that has happened to America is called “the Obama problem.” And the secrets to how it started are all found at Columbia University.

First, how did Obama get into Columbia? In those days there were virtually no college transfers accepted at Columbia. Only the number one student at Harvard might have had a shot. Maybe. But Barack was a lousy student coming from a mediocre college (Occidental). So how did he transfer into Ivy League Columbia in 1981? It was literally impossible.

I’ve always believed the only way Obama could have been admitted to Columba was as a “foreign exchange student.” Columbia U. loved letting in students from exotic countries- like Indonesia (where Obama grew up). It was a fast-track way to gain acceptance into Columbia.

Which is fine. Except for the fact that if Obama claimed Indonesian citizenship to get into Columbia U, then he was never qualified to serve as President of the United States.

Secondly, how did he graduate when he was never there? We were in all the same classes as Pre-Law and political science majors- yet I never saw him once. Neither did any classmate I’ve ever spoken to. Neither did any professor I’ve ever spoken to. Obama was literally “the Ghost of Columbia.”

I’ve always believed he was either a CIA plant who was given a Columbia U. degree without ever stepping foot on campus, or he spent his two years at Columbia’s sister school in Moscow studying Communism 101.

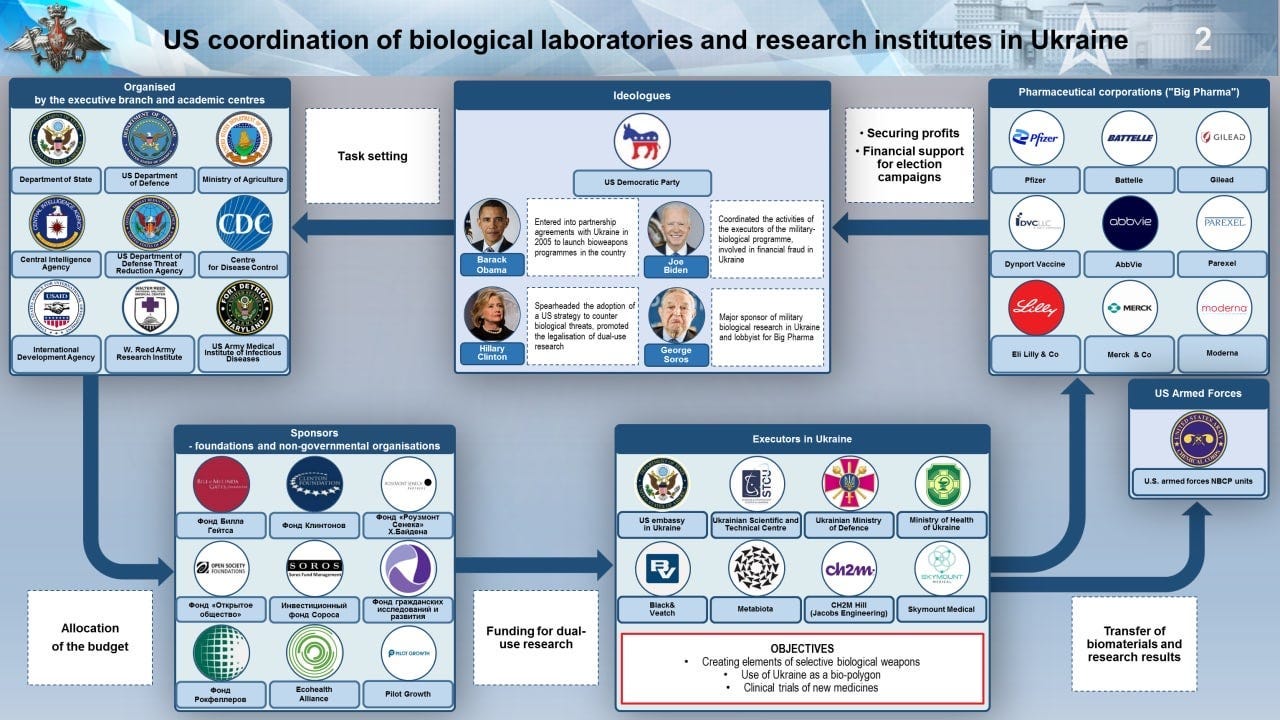

Lastly, his entire agenda has always been built around a strategy we all learned at Columbia called “Cloward Piven.” This plan was created by two Columbia professors- a husband-wife communist team named Cloward and Piven.

Whether Obama was ever actually in class at Columbia, or not, his entire agenda and strategy has always been built around “Cloward-Piven.” This plan was a detailed “how to” strategy to destroy America, and capitalism, and the great American middle class, by getting everyone on welfare, food stamps and free healthcare, until the debt explodes, the economy is overwhelmed, and the country collapses.

Sound familiar? Recognize this plan? It’s exactly what was carried out in Obama’s two terms, and then exploded times one thousand in Obama’s third term (with brain-dead puppet Joe Biden as the frontman).

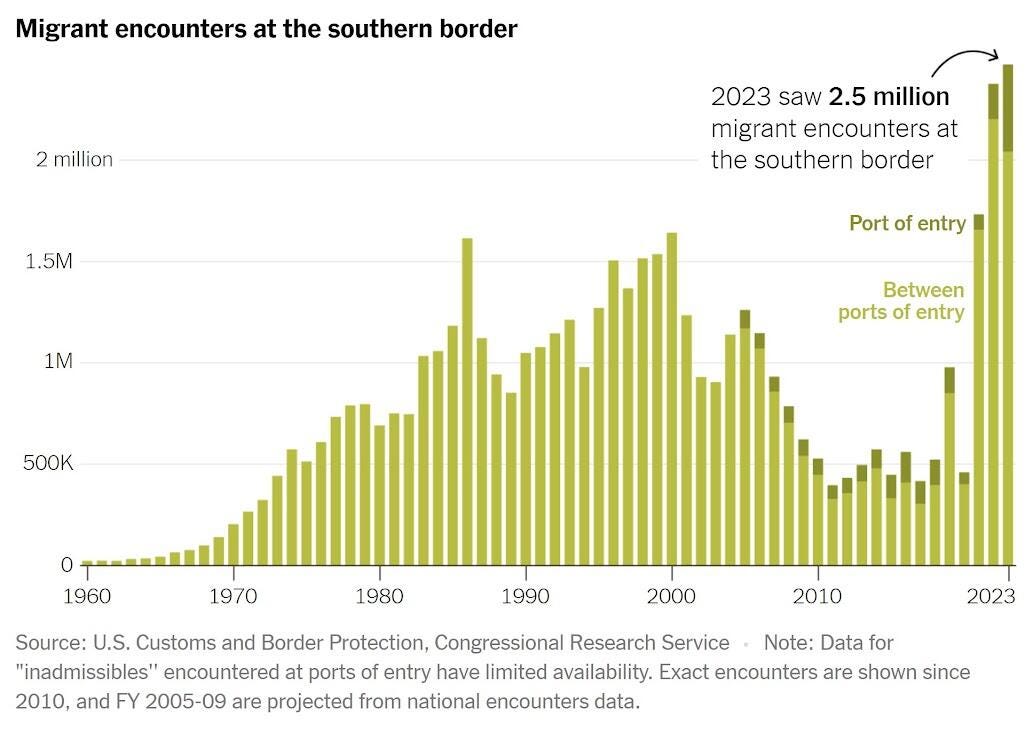

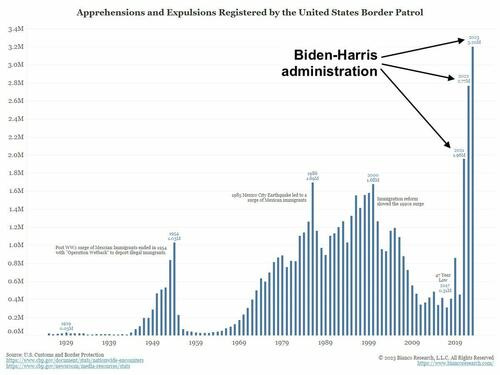

But instead of just trying to get everyone in America on welfare, food stamps and free healthcare, Obama expanded the plan on steroids with open borders. Obama and his communist cabal welcomed the entire poverty-stricken and welfare-dependent third world into America to bury our country with debt, overwhelm the economy, and collapse the country.

Obama also added another twist- which he probably learned from studying communism at Columbia’s sister school in the Soviet Union…

WEAPONIZATION OF GOVERNMENT.

Obama used government agencies to destroy his opposition- just like the Soviet KGB. Trump was the target. He received the bulk of the persecution and lawfare. First Obama ordered the spying on Trump and his campaign…then Obama ordered the persecution of Trump with a fraud called “Russian Collusion”…then Obama ordered the indictments against Trump…then Obama, in collusion with New York state communist politicians, ordered the civil suits against Trump to take away his assets and bankrupt him.

But long before the Trump persecution, there was my persecution.

Obama began and sharpened his obsession with weaponization by ordering the IRS to destroy his political opposition. Before he targeted Trump, he targeted yours truly.

I was at the top of Obama’s “Enemies List” for the “crime” of being a regular guest on Fox News and not only exposing Obama for the communist traitor he was (and still is), but also for daring to expose his scams at Columbia U.

Obama sent the IRS to destroy me from 2010 to 2013. I was attacked day and night by Obama’s version of the Gestapo/Soviet KGB. Like Trump, I survived, but lost tremendous amounts of money, and time, and endured tremendous stress and anguish.

I believe the attacks and scams perpetrated on America, capitalism, the US economy, and the great American middle class, all started at Columbia U. with Obama’s lies, fraud, scams, and”Cloward-Piven” education.

And the weaponization, lawfare and persecution perpetrated on President Trump, started with Obama persecuting his Columbia college classmate- Wayne Allyn Root.

My advice to President Trump, FBI Director Kash Patel and Attorney General Pam Bondi…

First, all roads lead to Obama. He is the man behind the spying on President Trump, the “Russian Collusion” scam, the green energy scam, the intentional destruction of America with open borders, and the persecution of President Trump. It all starts and ends with Obama. He called all the shots. Investigate and prosecute Obama.

Second, the secrets that launched this evil communist “Manchurian Candidate” all started at Columbia University. Go back to Columbia. Demand to see Obama’s files. Demand to see how he admitted to Columbia. Demand to see his attendance records. This scam will all start to unravel.

All roads lead to Obama.

Armstrong: Democrats Are Frauds, Grifters & Fools with Little Substance or Common Sense

Mostly from Martin Armstrong:

Most Democrats reject democracy. It is either their way or no way.

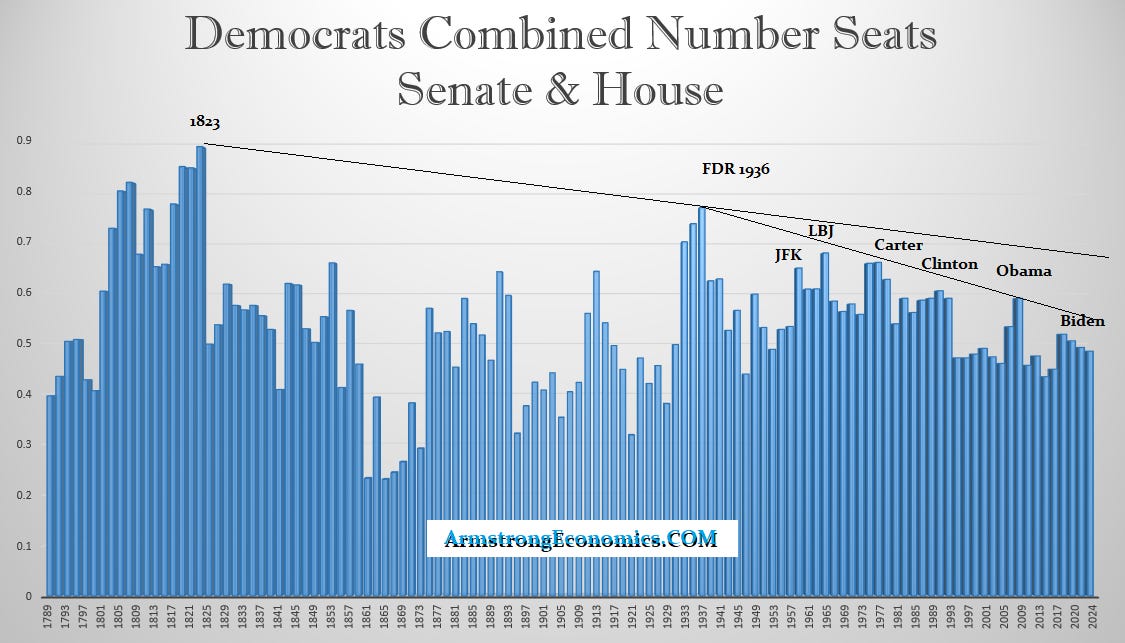

They have become so deep in their own lies and CORRUPTION that it is embarrassing internationally. I have warned that Socrates is forecasting the collapse of the Democratic Party. The Socrates computer will be correct. It has never been wrong because it is not biased.

Like Revolver said:

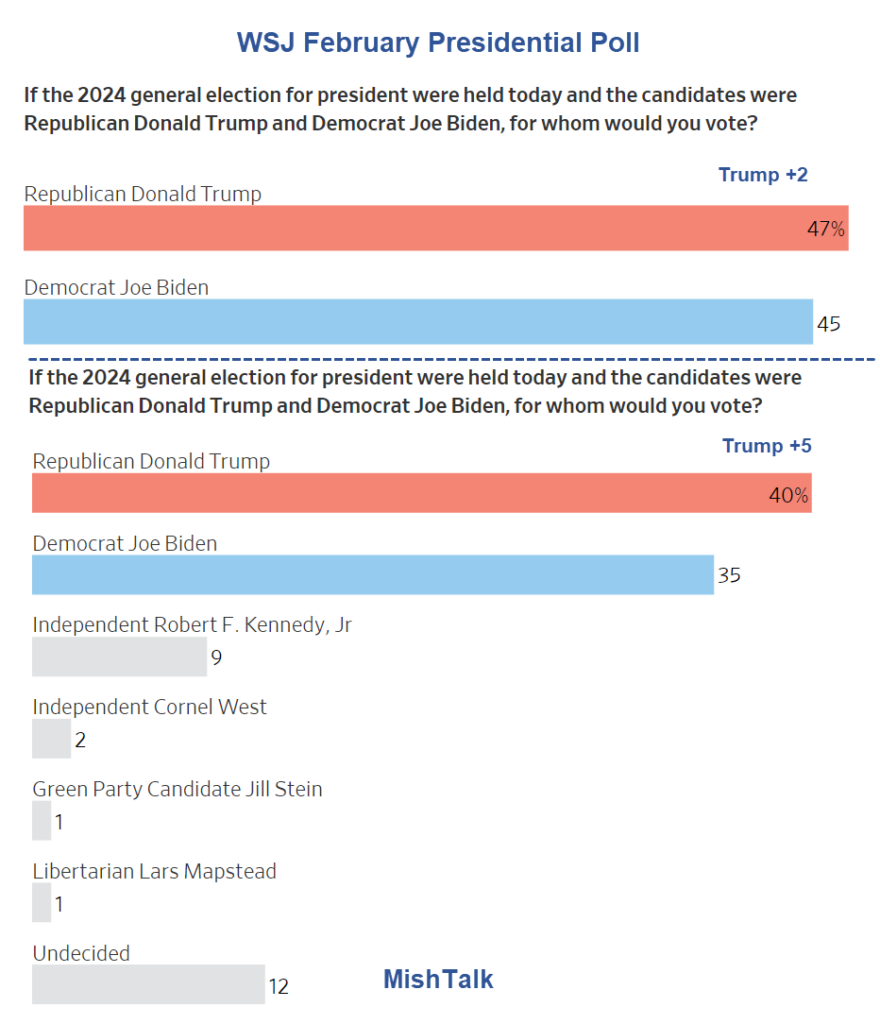

Dems are totally disconnected and they have a massive problem—they’re pandering to the unhinged 20 percent while the other 80 percent look on, wondering where common sense and sanity went. This is the infamous 80/20 problem, and it’s exactly why President Trump won in a landslide in 2024.

Trump planted his flag with the 80 percent on every major issue. The Democrats, meanwhile, bet everything on the radical 20 percent—and they lost big [sort of]

But what’s truly remarkable is that they’ve learned nothing. They’re still doing it. Stuck in the same 80/20 loop, doubling down on the losing side. And it’s killing their party.

Like the Federalists who also tried desperately to impose dictatorial power from a centralized government commanding and overruling local state culture and policies, this is their fate.

They are too stupid and too wrapped up in the demonic hatred of anyone who opposes them; they have become a cancer eating away at the unity of the United States. Sadly, this behavior leads to at least the collapse of their political party and the breakup of the United States, for they are too blind to see their own actions. In the worst-case scenario, we end up in a civil war. Their best days were when they advocated slavery—[Doug here: yes they were the party of slavery, never forget that. It was the Republicans who freed slaves and enforced civil right TWICE; once in 1860s/70s and AGAIN in the 1960s.]

They then turned to Marxism for FDR; then they tried civil rights with LBJ: all great labels but no substance. It has always been about just retaining personal power and the flow of money into their pockets, like USAID.

What are they fighting for? Transgender opera they were funding in Columbia?

|

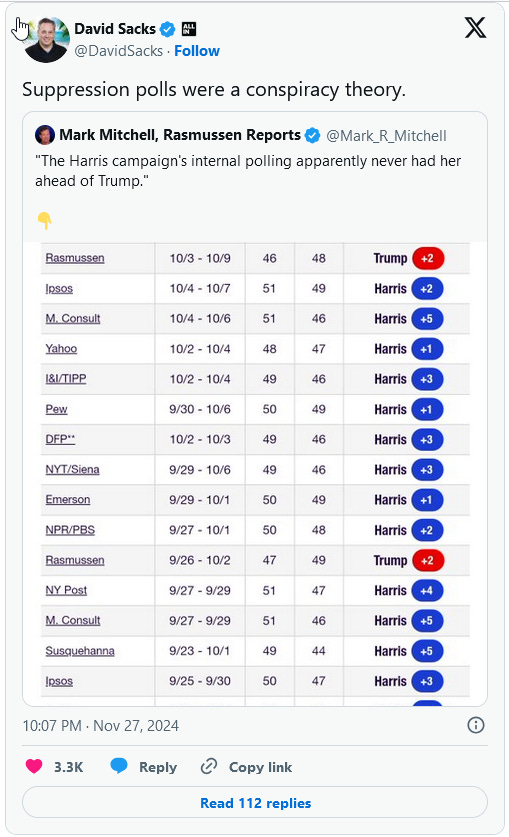

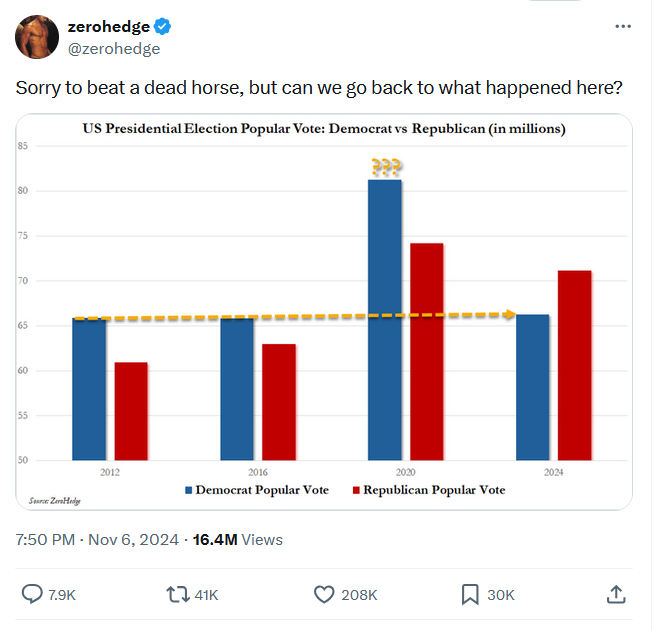

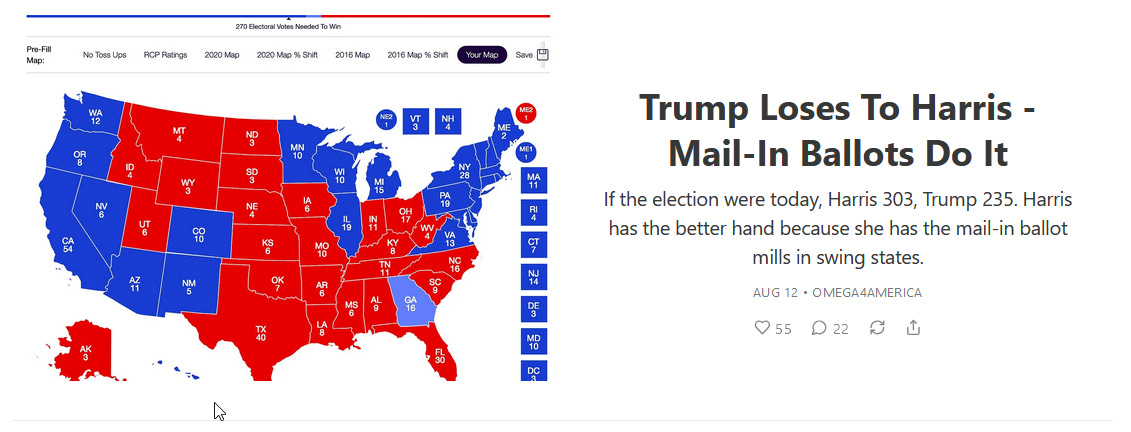

| Democrats are in a “bear market.” Wait ‘til we stop the voting frauds! |

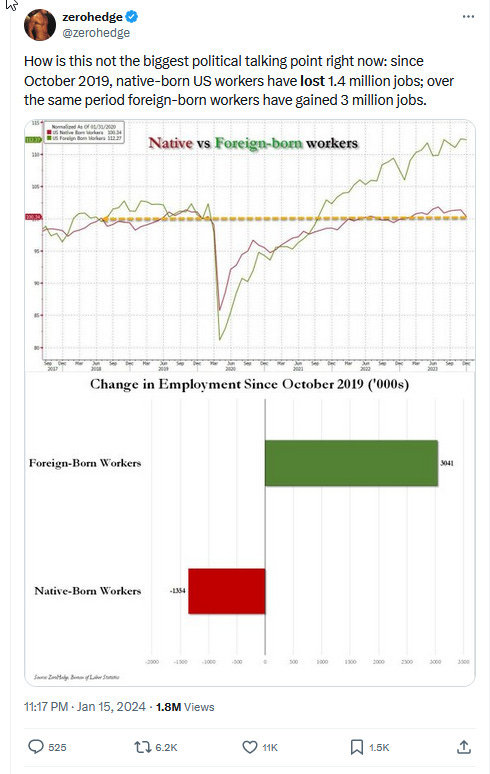

[Doug here: Wait ‘til the many decades of Democrat election frauds are exposed. Even in 2024, many Senate and House seats were stolen, even as Trump squeaked by. There would have been a much larger Republican majority in the Senate AND House if no cheating had occurred in 2024. Remember, the Democrat’s importation of 30 to 40 MILLION (in total) illegals in recent decades was all about winning elections and increasing electoral votes into perpetuity—country be damned.

Already the multi-billion dollar slush-fund, otherwise known as USAID, has been halted and it funded many, many of the Democrat-captured NGOs and many Leftists with subversive and/or sinister intent. ]

There are some Good Muslims, Like There Were some Good Nazis

https://youtube.com/shorts/AO-ZUr7bNk0?si=z-qYvZqstpqkDlrS

This is a follow-on video from the great Raymond Ibrahim that I posted recently: "Fear of Islam,"ie., Islamophobia, Has Been the Rational and Justified Position Among Non-Muslims for 1400 years...”

It’s likely that you personally have never experienced Muslim communities in any kind of depth and you probably have not seen their culture up close and personal. Muslim communities are VERY different than life in America.

I lived in Jakarta for 2 years and generally enjoyed it. Of course, I didn’t live in the grinding poverty that surrounded me. I lived in a high rise apartment in Central Jakarta, and there was a small “river” flowing nearby that was literally a moving and smelly garbage heap. All of this garbage flowed into the nearby Java Sea. I’m sure there are 100s of such tributaries across the island of Java and other places in Indonesia. I went snorkel diving around the “Thousand Islands” about 40 km north of Jakarta in the Java sea. It’s an ok place, but when I went snorkel diving, there was zillions of plastic bags just floating around. It was bad.

In Sumatra, the local “culture” of burning rice fields ruins the air quality in the entire region for about a month or two; including in Singapore and Malaysia. It would be better to plow-under the rice plants—which would be much more sustainable farming technique—and wouldn’t choke the region in smog. Mind you, the Thai farmers up near Chiang Mai do the same thing. The region has complained but Indonesia says that “it’s a cultural thing.”

In my post The Murderous Scourge of Islam Continues: the 'Palestinians' and 100+ Years Of Hatred and Murder, I talk about how militant the Muslims were in North Sumatra. They fought the Indonesia government for decades. Supposedly they were very “conservative” but I hear that they were a bunch of miserable, violent people and pot-heads. I mentioned in that post, that only after a vast wall of water killed 100,000+ people, ie., the tsunami in 2004 which hit offshore Banda Aceh, that ONLY THEN was there peace in Aceh. I made the point that you’d likely have to wipe-out the Gazans in the same way, to have any peace. Palestinians lived and died by the slogan “from the river to the sea” where they maintained a steadfast desire to MURDER ALL JEWS since the 1920s (and before) until today.

Now, the Israelis are finally giving the Gazan Muslims what they wanted for Jews: complete and utter destruction of Gaza or basically “from the river to the sea” FOR THOSE INTRACTIBLE MUSLIMS. Be careful of what you wish for.

You see, the Gazans were a special kind of haters. Hating was their life. It’s a pity because 2 million very moderate Muslims live and thrive within Israel proper.

Let’s talk about other Muslim characteristics.. Muslims uniformly want their women barefoot, pregnant and relegated to the kitchen. No women’s lib for you Kafirs/Dhimmi!! And no school for you little Muslim girls in many Muslim countries—and no career or independence. Up until recently, women weren’t allowed to drive in Saudi Arabia.

Did I mention their history of piracy? The US and Thomas Jefferson fought our first foreign war in ~180405 against the Muslim scumbags in N. Africa; the Barbary muslim pirates. They had no problem plundering passing ships and making sex slaves of the women taken from merchant ships in the 1700s to 1800s. They made slaves of the men or just killed them.

Remember the Somali pirates?? …the Yemen pirates? I was in SE Asia much of last year and I heard that you could no longer take boats from Palawan to Malaysia Borneo. The reason: muslim pirates. The Philippines today has a huge problem of murder and kidnapping in Southern Philippines. Nice people those Muslims!

I remember when Biden suddenly left Afghanistan, the highest priority of Muslims was to withdraw all the girls from school — to remind girls of their subservient status. The muslim men can’t tolerate any girls/women having any knowledge since that would challenge their patriarchy. You hear that, you “woke” idiots???

I’m tired of writing about this subject, so if you’re interested, just browse the titles below—it’s just a short list. You can search “Bing” for Islam “Gulfcoastcommentary” for a long list of articles. I’ve said it “all” before about the world-wide, murderous scourge of Islam.

Palestinians-100+ Years Of Hatred

It's Not Just Gaza: Islam is the Greatest Murder Machine in Human History

The Grand Mufti of Jerusalem and the Fuhrer

A Violent Minority Ruins the Reputation of Entire Groups: Islam Edition

Why Continue To Pretend Islam is a Religion?

Islam: Making a Difference, One Body at a Time

A Pandemic You Rarely Hear About: 360 Millon Christians Persecuted Worldwide

A Pandemic You Rarely Hear About: 360 Millon Christians Persecuted Worldwide

Raymond Ibrahim: Europe Welcomes It's Historic Enemy with Open Arms

etc, etc, etc…..

Wednesday, February 26, 2025

Essential Gulfcoastcommentary Index 2024

Also take a look at the same index on Substack

November 2024

Data Experts Have Already Found 3.5 Million Bogus Ballots in 5 Swing States

October 2024

September 2024

An Apparent Coup in the White House; Biden and Blinken Likely Sidelined

Armstrong: Slavery is Alive and Well in 'Prison Nation' Amerika

August 2024

July 2024

PCR: German Courts Treat Disgusting Islamist Pigs & Gang Rapists better than the Native Woman Victim

June 2024

What HAVEN'T Black People Ruined?

Sorrow for our Youth Whose Lives Were Needlessly Snuffed-out by the MNRA "Vax"

Timely Lessons About Tyranny from the Father of the Constitution

May 2024

Armstrong: Why War is Inevitable & the Outcome Highly Destructive

All Rule and Government Are Evil to the Core when 'Natural Law' is Abandoned or Subverted

A Timely Re-post: Differences in Intelligence Cause Clashes of Civilization

‘Europeans Will Succumb to Islam,’ Says Former Intelligence Chief

April 2024

[Repost from August 2020] Only a Brutal Purge of the Left Can Save Us

Bogged-Down In Bullshit: The US is Now a "No Can Do" Country, Part 2

March 2024

Archbishop Viganò: ‘The globalist cabal want to establish the kingdom of the Antichrist on earth’

Kunstler: Is Our Bolshevik Freakshow About to Meet the Counter-Revolution?

Trump Tells Crooked Joe and his Insane, Lying Band of Bolsheviks: "You're Fired!"

February 2024

El Salvador President Nayib Bukele Warns CPAC of 'Dark Forces' In Our Country

Javier Milei Oversees 1st Monthly Budget Surplus in Argentina Since 2012

'Barack Obama' Was Entirely a CIA Project: The Untold History of Obama and the CIA

Tucker's Interview with Mike Benz: The National Security State & the Total Inversion of Democracy

January 2024

![[Updated] After Decades of Subsidies and Hysteria, Wind and Solar Power Contributes Just 6% Of Germany's Total Energy Requirements [Updated] After Decades of Subsidies and Hysteria, Wind and Solar Power Contributes Just 6% Of Germany's Total Energy Requirements](https://substackcdn.com/image/fetch/w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fd98d628c-0eb1-4797-b42c-be420e8474f0_1920x2253.png)