It's possible that with the amount of government and corporate borrowing underway, the overnight 1.5% interest rate is too low relative to the demand for money. Government borrowing is accelerating due to tax cuts and spending. It's even possible that a recession is unfolding now causing government deficits to surge. Hedge funds, who can tap the Repo market (repurchase agreements), may be over-leveraged and desperate for money. Rates are trying to rise, but the Fed won't let it happen. This implies that the Fed may not be able to step away from these markets going forward and likely will have to re-start Quantitative Easing on a long-term basis to buy US debt--which essentially monetizes the US deficit.

This is the stuff of the Weimar Republic. No wonder gold prices are perking up.

The Worldwide Financial/Liquidity Crisis Has Likely Begun

This Repo crisis is the beginning of the next financial crisis. We are in it. Banks were/are not lending to other banks and/or hedge funds probably because of the counter-party risk. And The Fed is not explaining anything about this, presumably to avoid creating a panic. Even in recent press conferences, Jay Powell is not even asked questions about this by reporters, presumably by agreement with the press to keep this all secret. Meanwhile the stock market is soaring into bubble territory due to the tsunami of liquidity.

All of these Repo operations are short term to very short term (overnight). Going into early 2020, most of these liquidity injections are scheduled to reverse. This is an effective tightening if nothing changes. Here's a chart of Repo "roll-off" going forward assuming no further massive liquidity injections:

Starting now and through the first two weeks of January 2020, liquidity may shrink and stock prices correct. Since markets are not allowed to go down now, I suspect that the Federal Reserve will ramp-up Repo money again or begin QE4 (that they promised they wouldn't).

European Banks and the Euro Will Destroy the World

The Europeans never allowed any banks to fail during the GFC in 2008, whereas some 157 banks failed and many mergers were arranged in the US during that recession. So nothing was allowed to fail in Europe. No bad debt was eliminated. So EU bank stocks are at 30+ year lows because everyone knows that they are loaded up with bad loans that are papered-over with "mark to fantasy"ratings. The other reason that the EU is faced with a banking crisis is that negative interest rates has effectively crippled the profitability of banks along with profit-killing regulations.

The actions of the ECB to drive interest rates to negative levels is the most irresponsible monetary "experiment" in the history of the world. It's artificially driven up bond prices to truly absurd levels. There are still some $17 Trillion of debt in the EU that have negative yields. It's the biggest bubble in the world! And there's no way out!

But now there's a chorus of "economists" across the world, especially Europe, who are also increasingly critical of negative yields. It's becoming a consensus. It's because QE and negative rates haven't helped; they've hurt and caused damage to retirees, pension funds, insurance companies and most importantly the banking system (especially Europe). Just a week ago, Sweden raised it's interest rate from -0.5% to 0% because of the damage negative rates are causing: housing market price bubbles, bank and pension troubles were cited.

So, we're one populist revolt in a single EU country like Italy or Greece leaving the EU that could begin a real bond rout. Or it could simply be credit markets revolting due to rising risk. What if the ECB, like Sweden, decides to abandon negative rates now that there is consensus that it's actually crazy?

EU banks are large holders of dicey sovereign bonds like Greece and Italy - countries suffering under the yolk of the Euro currency. Germany has loaned 100s of $billions to Southern Europe as the Euro currency has imposed a non-stop economic depression on the southern countries. This was predicted long ago by Margaret Thatcher. Such transfers are not sustainable. Economic hardship is causing unrest and populist and/or separatist movements all over the world including Europe. Brexit was first, but who's next? If a country like Italy leaves the Euro currency, it's bonds would drop by about 70% to yield something like 7% from 1.4%. Since European banks are big holders of sovereign bonds, such an event would tip every bank in the EU into insolvency. One hiccup in a EU member's bond market (like Greece or Italy) and say hello to bank failures galore in Europe. Suffice it to say that EU banks are an ongoing problem for the world and probably an existential threat to the world of finance.

The effect could not only include the instant bankruptcy of nearly all EU banks whose effects would spread to the US and World. The ECB itself would be understood to be technically bankrupt. Bank runs could easily erupt since large depositors are at risk of losing their money for bail-ins in the event of an EU bank bankruptcy. A flood of money to the US would ensue. The dollar would rocket higher as US causing crises in emerging market countries that have issued dollar-denominated bonds --which is a huge amount.

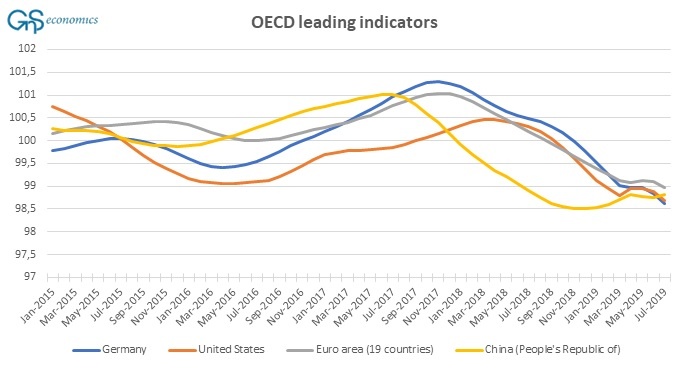

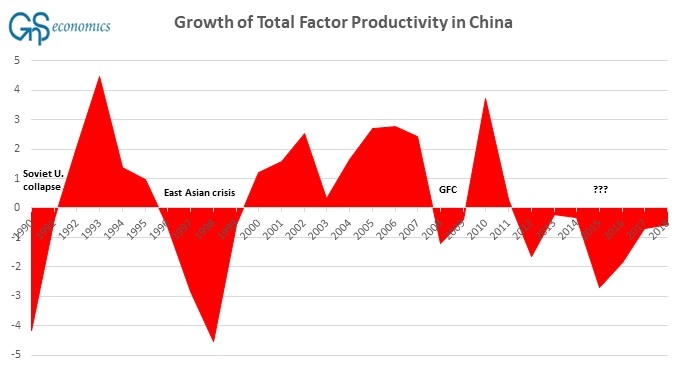

In my post titled Declining Global Money Supply Taking World Economy With It, I mention that the real dollar money supply for world commerce was found in the Eurodollar markets of European banks. This market is the dollar supply especially for all of the international and emerging markets and China. Really, it's the money supply to the world. (The US Federal Reserve, for decades, has refused to see this phenomenon showing their utter incompetence -- they really don't know what they are doing.) But all of this liquidity depends on the soundness and confidence in the EU bank's balance sheets. And we know they are sketchy. For this reason, the Eurodollar market has been in decay, especially since 2008 and after 2011. Shrinking Eurodollars means a shrinking world economy. This is why China is stagnating. It's why all emerging markets are stagnating. It's why world trade is falling. I can't see it getting better --only worse.

How We Got Here

From my post in February 2018 "Extremes in Unsound Money and Unsound Will Lead to Catastrophe,"I said that "In 1970, US debt was $275 Billion. It took 188 years to achieve that. This past week alone, the government sold $258 billion! In the past 6 months alone, US debt has exploded by $1 Trillion. And this is during "good times."

In 1971, Nixon ended the Post WWII Bretton Woods arrangement which ended any semblance of (gold-backed) sound money. As an immediate result, our national debt and inflation began to skyrocket. Central bank activism and "experimentation" increased as they tried to tame the increasingly unstable business cycle---that THEY caused!

The big banks have once again become highly risky hedge funds using your money to gamble on highly leveraged positions in risky derivatives (again) thanks to the repeal of Glass-Steagall in 1991. They act with impunity since they have the government's backing when they fail again.

The rise of the Eurodollar market sprung up in Europe and provided massive liquidity to the world from the late 1980s to 2008. Bankers used an accounting trick to hide their increased leverage (in order to avoid violating bank capital rules). It worked until 2008. Just 11 years ago, the world had a financial near-death experience as derivatives failed, banks failed and markets failed. The world economy come to a halt as 'finance' failed.

Remember, if finance fails then everything else fails and millions, even billions, of people may die as world supply chains collapse, commerce halts, shortages develop, grocery store shelves empty and people begin starving. Longer term, infrastructure fails-- including even electricity and utilities. I know it's unthinkable, but that's how bad it could get. That's not a prediction, though.

Debt, deficits, trade deficits, financial market and price inflation, repeated bubbles and the resulting instability (burst bubbles) and deep recessions have serially eroded our economy and culture since 1971 really, but especially since 2001. The result, in part, is that our society, our culture, our civic order, our work ethic, our moral bearings have all decayed and diminished. Our social contract has also been torn asunder. It's not just in the US, but all over the world.

China saved the world with it's massive debt-fueled spending spree in 2009 until about 2 years ago. China started "hitting the wall" in about 2013. I've written many blog posts indicating how China and Chinese companies are now so indebted, that a financial crisis is basically a given. Also see my posts We're Reaching the End of a Long Road and The Path to Recession, Crisis and Global Depression.

US Federal Reserve Is Now Causing the 3rd financial crisis in 20 Years

Central Banks, in their efforts to “save” the world economy since 2009, have created a monster: a dysfunctional, extremely-speculative and highly-leveraged financial sector. It's clear that 2019 stock market is becoming a big bubble, up some 30% in 2019 with earnings down ~5%. The monster is awakening again.

After the Federal Reserve's effort to reduce it's balance sheet and raise interest rates in 2018, the US stock market started correcting strongly in December 2018. We learned that EVERY market was crashing with stocks: the high yield and other segments of the debt markets. This is the big problem and is why the Fed can't allow stocks to go down. If stocks go down, EVERYTHING goes down-- including the economy. There is a sense of terror in the government at what they've created. It's either "inflate the bubble" or face calamity (as outlined above). But when Europe (and/or China) goes into crisis, this may really cause panic by the monetary authorities. The Fed are now fire fighters, with a policy of putting out every fire immediately. After decades of fire fighting, tinder has been accumulating meaning that risk of an inferno keeps rising. Think Yellowstone in 1988, when the government decided to reverse course and allow some fires after 70 years of a "No Burn" policy. Result: inferno!

A big fire has erupted again and it's not clear if it can be contained.

The massive liquidity injections that we have seen in Repo this fall have been seen before, first by the Fed in the run-up to Y2K in 1999, and also just before/during the 2008 crisis. Now we're seeing it again. The aftermath in the first two occasions included a 50% plunge (80% in Nasdaq stocks)in 2000/2002 and 60% decline in stock markets and a huge recession in 2008/'09. Central bank interest rates went down 600 bps and 500 bps respectively and was unable to stop the rout. Now, the Fed has a measily 150 bps to lower -- it's probably not enough. Euro has no capability to lower rates at all. China does but they, themselves, are teetering with bank and corporate bond failures proliferating.

The entire world has become a house of cards: China, Europe and even the US. As I mentioned, the size and scope of the current financial bubbles mean that "markets" are an existential threat to the world. One day, there will be that dreaded inferno.

Rather than face the inferno, the "authorities" keep propping up the equity bubble. From the Felder Report, stock market bullish sentiment (based on trader positioning, ie., the measure of Rydex traders’ assets in bear funds and money market funds relative to their assets in bull funds and sector funds --inverted in the figure below) has only been this high on two other occasions during the past 20 years: August 2018, January 2017. Bullish positioning in 2000 was lower than right now!

Central banks and "governments" are destroying markets, our economies, our societies--really everything with their never-ending manipulations and distortions. At some point the inferno will be too big.